Strategic finance stands as the foundation for any business aiming for enduring success, merging the precision of financial management with the vision of corporate strategy. This approach acts as the company’s navigator, guiding through market fluctuations with an eye on long-term growth and shareholder value. It’s about making calculated decisions that secure not only immediate benefits but also future prosperity, transforming finance into a proactive force within the business.

Fundamentals of Strategic Finance

When I tackle strategic finance, I see it as blending financial expertise with a forward-thinking mindset. It’s about lining up every financial decision, big or small, with my company’s grand vision. This holistic financial management approach hinges on setting clear financial goals and striking a balance between short-term performance and long-term objectives.

Elements of Strategic Financial Management

- Financial Goals: These are the tangible targets I set, like revenue growth or cost reduction.

- Long-Term Objectives: I think of these as broader aspirations, including expanding market share or bolstering profitability.

- Financial Strategies: These are my game plans for reaching my goals, whether it’s through investing, cost management, or otherwise.

- Performance Goals: These are specific, measurable outcomes I need to hit to keep on track with my financial objectives.

Strategic finance is not just about the numbers; it’s a way of thinking that informs every financial move I make with an eye on the future. It requires sophisticated planning and often a robust set of financial tools that allow me to analyze and forecast multiple scenarios. Mastering strategic finance means I’m always prepared to steer my resources toward not just surviving but thriving in the long haul.

To summarize, strategic finance is a proactive, all-encompassing approach to managing a company’s finances that emphasizes the importance of aligning every financial decision with strategic business objectives. It’s a blend of tactical planning, analysis, and the smart allocation of resources, all in service of achieving a sustainable competitive edge.

Role of the CFO and Finance Leaders

In my journey through the landscape of strategic finance, I’ve witnessed firsthand how vital the Chief Financial Officer (CFO) and their finance leaders are. They’re not just number-crunchers; they’re strategic partners in steering a company’s future.

Evolution of the CFO’s Responsibilities

The role of CFOs has evolved significantly. Historically focused on managing a company’s financial statements, today’s CFOs are instrumental in strategic planning and decision-making. Their insights help shape the organization’s financial future and adapt to market trends, such as the increased intersection of digital and finance. They’re expected to balance risk management with innovative growth strategies, often serving as a central figure in discussions that shape the business’s trajectory.

Leadership in Financial Decision-Making

CFOs and finance leaders are at the forefront of financial decision-making. They analyze and interpret complex financial data to make informed decisions that will impact the company’s performance and alignment with its strategic goals. Effective CFOs will communicate these decisions and their implications both within the finance team and across the entire organization, ensuring there is a common understanding of the financial direction. My role often involves collaborating with other leaders to ensure our financial strategies are robust and geared toward sustainability and profitability.

Finance Team Dynamics and Collaboration

Building a strong finance team is pivotal for success in strategic finance. A well-structured team, led by competent leadership, not only drives efficient financial processes but also fosters a collaborative environment where strategic ideas can flourish. I always emphasize the importance of team dynamics and collaboration. Within the team, each member plays a role in supporting the CFO’s agenda—whether that’s through modeling good financial and team-building practices or devising strategies for digitization and analytics. Together, we’re more than a finance team – we’re strategic partners in the business, and that’s a thrilling place to be.

Strategic Planning and Analysis

In the realm of strategic finance, the core focus is on meticulous planning and analysis. My guide here is designed to underline the importance of creating robust financial plans, employing sophisticated forecasting models, and leveraging advanced analytics to aid decision-making. Let’s navigate through the essentials of crafting a strategic financial blueprint.

Developing a Strategic Financial Plan

The cornerstone of any strategic plan lies in its ability to outline the company’s financial direction. Financial planning is about setting KPIs and objectives that align with the overall business vision. I start by identifying key metrics that are crucial for tracking financial health and pinpoint strategic initiatives that will drive growth. A sound strategic financial plan should bridge the gap between where the business is currently and where it intends to be.

Financial Forecasting and Modeling

Forecasting is a predictive component that plays a critical role in strategic finance. I use it to prepare for future outcomes based on historical data, current trends, and strategic assumptions. Financial models allow me to tease out various scenarios, helping stakeholders understand the potential financial impact of different strategic choices. My models include projections of income, expenses, and cash flows, which evolve into comprehensive financial forecasts.

Advanced Analytics and Business Intelligence

To bolster decision-making, I harness advanced analytics and business intelligence. These tools offer deep insights by analyzing large volumes of data through sophisticated algorithms. I focus on extracting actionable information that can form the basis for strategic adjustments. By doing so, I enable the business to pivot quickly in response to market trends or internal performance indicators.

Financial Resources and Budgeting

In strategic finance, financial resources and budgeting are crucial pillars. I focus on optimizing cash flow for liquidity, managing expenses judiciously, and allocating budgets to fuel growth.

Optimizing Cash Flow and Liquidity

I prioritize maintaining a healthy cash flow to ensure that my business has the liquidity necessary to cover day-to-day operations. By analyzing assets and liabilities, I determine the best strategies to increase cash reserves and accessible funds.

- Regular review of accounts receivables

- Negotiation of payment terms with suppliers

Effective Spend Management

Tracking and managing spend is an ongoing task. I make it a point to monitor where every dollar goes, trimming expenses wherever possible and ensuring they align with my strategic objectives.

- Refined procurement processes

- Deployment of spend analysis tools

Allocating Budgets for Growth Initiatives

Investing in expansion opportunities is essential. I allocate budgets carefully to back promising growth initiatives, always aiming for a clear ROI.

- Prioritization matrix to evaluate potential growth projects

- Regular alignment of budget distribution with strategic goals

By judiciously managing financial resources and budgets, I lay a solid foundation for sustainable financial health and growth opportunities.

Investment and Risk Management

In strategic finance, making sound investment decisions and effectively managing risks are crucial for sustaining long-term profitability and securing a healthy return on investment (ROI).

Strategic Investment Decisions

When I look at investment decisions, I focus on aligning them with my company’s strategic goals. This approach ensures each investment has the potential to contribute significant value. Analyzing long-term profitability projections is key, and I often weigh the expected returns against the associated costs. For instance, investing in new technology may come with a hefty upfront cost, but if the potential for market expansion or operational efficiency is there, it could promise a healthy ROI.

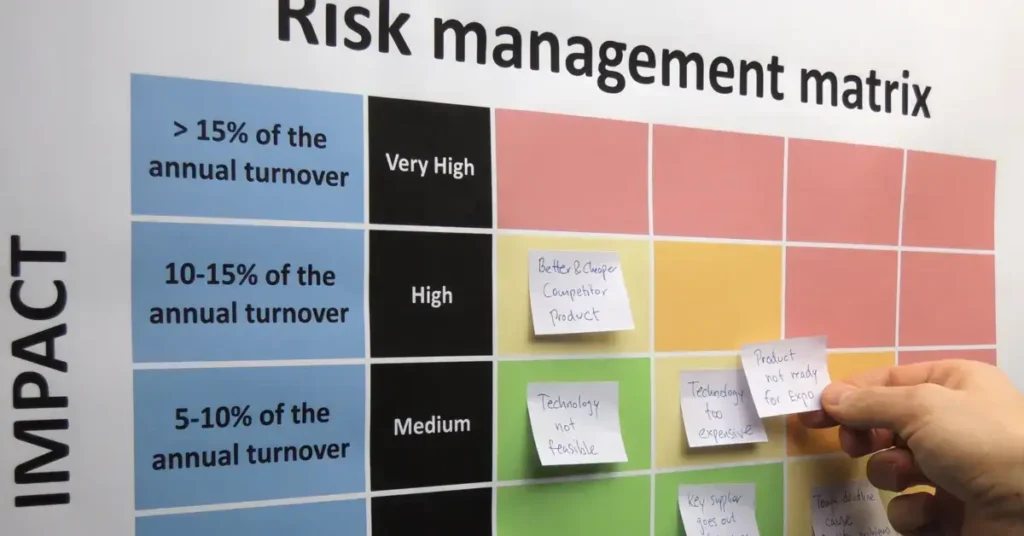

Identifying and Managing Risks

Risks are an inherent part of finance. I identify potential financial risks through careful analysis of market trends and internal processes. Once recognized, developing a robust risk management strategy becomes my priority. This might involve diversifying investments to spread and mitigate risks or setting up contingency funds to handle unforeseen market fluctuations. By staying informed about financial risk management strategies, I aim to protect my company’s financial health.

Capital Structure and Debt Management

The mix between equity and debt in my company’s capital structure is a delicate balance I must manage. A heavy reliance on debt can magnify financial risks due to interest obligations and potential insolvency during downturns. However, leveraging debt wisely can amplify returns on investments without surrendering ownership stakes. Practically speaking, I monitor debt levels to maintain a structure that supports strategic goals while minimizing risk. Maintaining optimal levels of debt enhances our financial resilience and could enhance strategic financial management.

Metrics, KPIs, and Performance Tracking

When I delve into strategic finance, I always emphasize the importance of clearly established Key Performance Indicators (KPIs), real-time dashboards for monitoring, and thorough analysis of financial data for fostering growth.

Establishing Key Performance Indicators

I begin by defining clear and actionable KPIs that align with our financial goals. Gross Profit Margin, Net Profit Margin, and Operating Cash Flow are essential for me to keep a pulse on the company’s profitability and liquidity. They serve as my compass in strategic finance, directing our efforts toward meaningful impact and success.

Utilizing Real-Time Dashboards

Next, I rely on real-time dashboards. These dynamic tools provide me with a snapshot of the company’s current financial status. By monitoring metrics like Current Ratio and Debt-to-Equity Ratio in real-time, I can make informed decisions promptly and stay on top of the company’s financial health.

Analysis of Financial Data for Growth

Lastly, I engage in rigorous analysis of financial data which is instrumental for identifying trends and driving growth. By examining changes in Revenue Growth Rate and Return on Equity, I can gauge the effectiveness of our strategies and adapt quickly, ensuring the continued growth and success of the business.

Technology and Automation in Finance

When I think about strategic finance, the first thing that strikes me is how essential technology and automation have become. They’re not just supporting roles anymore; they’re leading the charge in transforming financial strategies.

Impact of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are shaping the future of financial decision-making. By analyzing vast amounts of data, AI can uncover insights that would be impossible for me to find manually. I’ve seen finance departments leverage these technologies to predict market trends, optimize investment strategies, and manage risks more effectively.

- Predictive analytics: Machine learning models can forecast financial outcomes, which helps in strategic planning and market analysis.

- Risk management: AI algorithms assess and manage risk, screening for fraud more accurately than traditional methods.

Financial Process Automation

Financial process automation represents a shift from traditional manual entry to using software for automated financial tasks. For example, Robotic Process Automation (RPA) can handle repetitive tasks like data entry and reconciliations, which I used to do with Excel spreadsheets. This not only saves time but also increases accuracy by reducing human error.

- Task automation: Transforms processes such as invoice processing and report generation.

- Workflow efficiency: Streamlines financial operations, ensuring tasks are completed faster and with greater precision.

Integrated Software Systems and Tools

Lastly, integrated software systems are a game-changer in strategic finance. They provide an interconnected framework where all financial processes can be managed in one place. These tools have shifted the way I handle financial planning by offering real-time data and analytics, making it easier to spot trends and make informed decisions.

- Data centralization: Brings together disparate financial functions for better visibility and control.

- Advanced analytics: Offers powerful tools for in-depth financial analysis, beyond the capabilities of basic spreadsheets.

By incorporating these technologies into my financial strategies, I’ve been able to not only enhance accuracy but also provide deeper analytical insights. This is the power of technology and automation in finance: it’s not just about keeping up with the times; it’s about setting the pace for the future of strategic financial management.

Strategic Growth and Business Development

In my experience with strategic finance, the pathway to business expansion relies heavily on smart investment strategies, astute market moves, and a consistent focus on profit margins. Let’s explore how.

Funding and Managing Growth Initiatives

Funding growth requires a multi-layered approach that combines internal revenue streams with external funding sources. My approach often involves setting SMART financial goals to ensure that each investment is targeted and effective. To manage growth initiatives, it’s crucial to measure the performance against these goals and adapt strategies as needed. The goal is always clear: sustainable and scalable growth. For more detailed insights, read about Mastering Strategic Finance For Business Growth.

Mergers, Acquisitions, and Corporate Development

Mergers and acquisitions are cornerstones in the realm of corporate development. They provide a swift avenue to gain market share and enhance revenue growth. I advocate for an approach that ensures a thorough due diligence process, understanding the synergies and potential risks before proceeding. When used strategically, these moves can greatly accelerate business growth. To appreciate the nuances of incorporating M&A in corporate strategy, consider exploring some Comprehensive Guide for 2024’s Finance Leaders.

Driving Revenue Growth and Profitability

Driving revenue growth and profitability requires a clear vision and an understanding of the market dynamics. For me, key tactics include optimization of assets, innovation, and expansion strategies that adapt to changing market conditions. Ensuring a company maximizes its profit margins involves leveraging both short-term and long-term strategies effectively. Implementing a set of rules for growth, like those in Revenue growth: Ten rules for success | McKinsey, helps in establishing benchmarks and driving performance.

Communication and Stakeholder Engagement

In strategic finance, clear communication and effective stakeholder engagement are pillars of success. To foster trust and maximize shareholder value, it’s crucial I report with transparency, tailor financial communication strategies, and focus on value creation.

Reporting to Stakeholders and Building Trust

My experience confirms that consistent and honest reporting is key to building trust with stakeholders. Detailed financial reports and regular updates not only demonstrate my company’s commitment to transparency but also empower stakeholders to make informed decisions. For instance, providing quarterly earnings reports and annual forecasts allows stakeholders to gain insight into the company’s financial health and future direction.

Financial Communication Strategies

Crafting effective financial communication strategies requires understanding the needs and preferences of different stakeholder groups. I use a variety of channels, such as investor presentations, press releases, and social media, to share financial achievements and challenges. This multi-channel approach ensures that the information reaches stakeholders in a format that is accessible and understandable to them.

- Investor Presentations: Focus on key financial metrics and strategic initiatives.

- Press Releases: Announce significant financial events on time.

- Social Media: Engage in a more informal, direct dialogue with stakeholders.

Creating Shareholder Value

Ultimately, my efforts in strategic finance are geared towards creating shareholder value. By aligning stakeholder engagement with business objectives, I can drive value creation through strategic investments, cost management, and sustainable growth initiatives. This alignment ensures that stakeholder interests are considered in decision-making processes, thereby fostering long-term investment and support.

For example, launching a new product line might involve explaining the expected returns on investment to shareholders, highlighting how this aligns with the company’s growth strategy and contributes to overall value.

Opportunity, Innovation, and the Competitive Landscape

In the fast-paced world of strategic finance, recognizing fresh opportunities, fostering innovation, and understanding the competitive landscape are crucial steps toward business success. I’ll explore how these elements intertwine to form the backbone of effective financial strategy.

Identifying New Business Opportunities

I’m always on the lookout for new business opportunities, as they can arise from various trends or gaps in the market. It’s about being at the right place, armed with the right data, and the vision to see potential where others see none. A comprehensive assessment of market trends, customer needs, and the regulatory landscape is imperative. Take a close look at the insights shared on Aligning Financial Innovation with Strategic Objectives, where the importance of such evaluations is underlined.

Innovation in Strategic Financial Management

Innovation transforms strategic financial management, boosting a company’s performance and giving it a competitive edge. It’s not just about new products but also entails creative approaches to processes, business models, and financial tools. For SMEs, innovation is especially critical, as it significantly affects product quality and operational performance. Helpful tips on this critical topic can be found in the overview of Business Strategies and Competitive Advantage.

Analyzing the Competitive Landscape

To secure my place in the competitive landscape, I analyze the industry, its key players, and the factors that sway the market. Understanding where I stand among competitors allows me to align my strategic finance initiatives with the business’s overarching goals. Knowledge of current fintech’s growth and the technologies shaping the industry, like those summarized by McKinsey’s insights into fintech, is also valuable when considering the competitive landscape.

Frequently Asked Questions

What is meant by strategic finance?

Strategic finance is the practice of planning and managing a company’s financial resources to achieve its long-term business objectives. It involves aligning financial management with corporate strategy to drive growth, improve performance, and gain competitive advantage. Strategic finance focuses not just on budgeting and forecasting but also on steering the company towards a prosperous financial future.

What is strategic finance vs FP&A?

FP&A, which stands for Financial Planning and Analysis, involves budgeting, forecasting, and analytical processes that support a company’s financial health and business strategy. While FP&A is fundamental to a company’s operational finance tasks, strategic finance scales this a step further by integrating these financial insights into broader business strategies, often looking at longer-term horizons and bringing in a more cross-functional perspective.

What is a strategic finance job?

A strategic finance job typically involves roles where I am required to analyze financial data, develop financial models, and design growth strategies. It’s a role that encourages forward-thinking to influence top-level decisions. Individuals in strategic finance positions often work closely with senior management and various departments to guide the financial planning and decision-making processes.

What does a strategic finance manager do?

A strategic finance manager takes on the responsibility of driving a company’s strategic financial planning. They analyze market trends, oversee financial reports, advise on investment opportunities, and sometimes take part in scenario planning. My job would be to provide insights that help the business adapt to financial challenges and exploit financial opportunities.

Can FP&A lead to CFO?

Absolutely, FP&A experience is often considered a critical stepping stone towards the role of a Chief Financial Officer (CFO). The analytical, strategic, and leadership skills developed in FP&A roles are directly relevant to the CFO’s responsibilities. Working in FP&A allows me to gain deep insight into the business’s financial workings, which is essential for someone aspiring to the CFO role.

I hope you found some inspiration or useful tips in our article on strategic finance! If so, I’d love to hear your thoughts and ideas in the comments below! And if you’re looking for more insightful content, don’t hesitate to explore our other articles:

- Remote Finance Jobs: The Era Of Digital Economy

- Finance Director Jobs: Pathways and Opportunities

- Best Colleges For Finance: Top 10 U.S. Institutions

- Budget Worksheet For Teenagers: How To Start

Your comments help us create better content for you. Happy reading!