Saving $2,000 in just two months might sound like a steep challenge, but with a strategic approach and the right tools, it’s entirely achievable. We’ve all found ourselves in situations where a significant sum of money is needed in a short period, whether for an emergency fund, a special purchase, or kick-starting an investment. Therefore, understanding how to save $2000 in 2 months is not just about reaching a financial milestone; it’s about empowering ourselves to take control of our finances and make our money work for us.

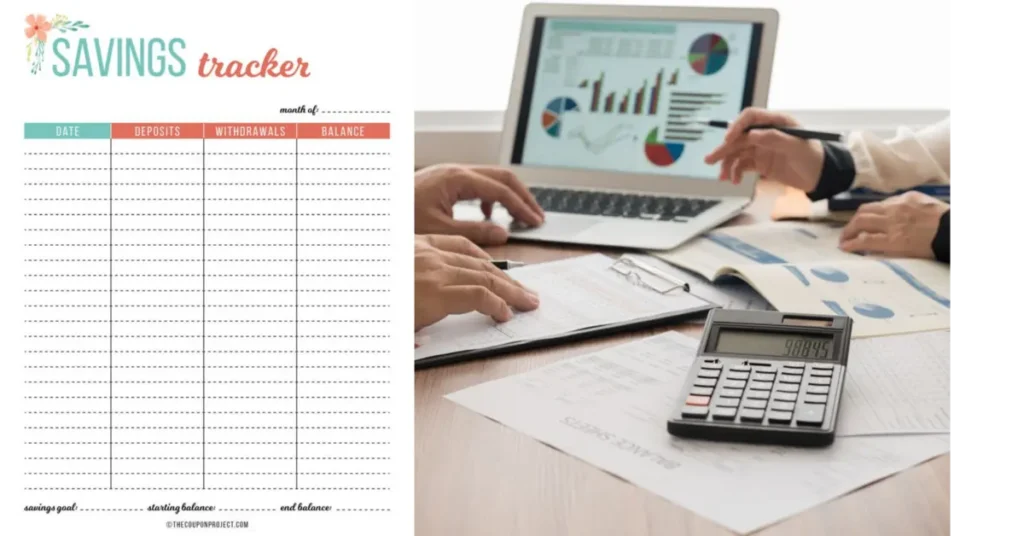

Implementing a savings chart can be a game-changer! It serves as a visual guide that breaks down your savings goal into manageable parts. By tracking each deposit, we make progress tangible and motivation constant. With some discipline and a clear plan, you’d be surprised at how quickly you can hit that $2,000 mark.

Key Takeaways

- A structured savings chart simplifies reaching a $2,000 goal in two months.

- Consistency and discipline in saving are crucial for success.

- Monitoring progress can increase motivation and help achieve savings targets efficiently.

Setting a Clear Savings Goal

Embarking on the journey of saving money can be exciting, especially when we have a specific target in mind. To effectively save $2,000 in two months, let’s break down this financial milestone into actionable steps.

Assessing Income and Expenses

First, we need to thoroughly examine our monthly income against our expenses. This means listing all sources of income and every expense, down to the smallest detail. It’s necessary to be honest with ourselves; overlooking even minor expenses can derail our savings goals. Drafting a comprehensive budget allows us to see the surplus income that we can set aside for savings.

- Income Sources: List all monthly income.

- Expenses: Itemize recurring bills, food, transportation, and discretionary spending.

Defining Your $2,000 Target

For the goal of saving $2,000 in two months, specificity is key. This means breaking down the total amount into smaller, more manageable figures.

- Weekly Saving: To meet our target, we need to save $500 per week.

- Daily Saving: This equates to approximately $71.43 per day.

Creating a how to save 2000 in 2 months chart can help visualize the goal and track progress.

Prioritizing Your Financial Goals

Our savings goal should align with our broader financial priorities. Perhaps we’re saving for an emergency fund, a significant purchase, or simply to bolster our financial security. By prioritizing this savings goal, we may need to identify areas where we can cut back or earn more. Remember, this isn’t about depriving ourselves but about making temporary adjustments to achieve our goals.

- Cutting Expenses: Identify non-essential items that can be temporarily removed.

- Increasing Income: Look for opportunities to earn additional income, if needed.

With a detailed plan and dedicated efforts, the objective to save $2,000 in two months is not only possible, but it can also be an empowering financial achievement.

Creating a Savings Plan

We all have financial goals, and if yours is figuring out how to save 2000 in 2 months chart, you’re in the right place. Let’s break down the plan with budgeting strategies and ways to cut unnecessary expenses.

How to save $2000 in 2 Months with Weekly Deposits

| Week | Deposit Amount | Balance |

|---|---|---|

| 1 | $250.00 | $250.00 |

| 2 | $250.00 | $500.00 |

| 3 | $250.00 | $750.00 |

| 4 | $250.00 | $1,000.00 |

| 5 | $250.00 | $1,250.00 |

| 6 | $250.00 | $1,500.00 |

| 7 | $250.00 | $1,750.00 |

| 8 | $250.00 | $2,000.00 |

How to save $2000 in 2 Months with Biweekly Deposits

| Week | Deposit Amount | Balance |

|---|---|---|

| 2 | $500.00 | $500.00 |

| 4 | $500.00 | $1,000.00 |

| 6 | $500.00 | $1,500.00 |

| 8 | $500.00 | $2,000.00 |

Budgeting Strategies

First things first, we need a budget that works for us. This is where we get to see the power of our income versus our expenses on a daily and monthly basis.

- Daily Saving Target: We need to save about $33.33 every day. Start by tracking all your daily spending from morning coffee to evening snacks.

- Monthly Budget: Split your goal into two monthly targets of $1,000 each. Look at your monthly income and decide immediately where this $1,000 will come from.

Creating a savings plan isn’t just about putting money aside; it’s also about understanding where our money is going. Make clear categories for your budget—housing, utilities, groceries, entertainment, savings, etc.

Cutting Unnecessary Expenses

Next, let’s comb through our expenses with a fine-tooth comb. Identify what’s essential and what’s not.

- Cancel unused subscriptions.

- Swap out dining out for homemade meals.

- Opt for free entertainment options.

Every cent not spent on these can go straight to our savings plan. Remember, small changes in our everyday spending can drastically improve the amount we save every month.

Developing Saving Habits

When we’re aiming to figure out how to save $2000 in 2 months chart, it’s crucial to establish consistent saving habits that will help us reach our goal. Let’s explore some specific strategies that can make this journey more manageable.

Daily Saving Techniques

To save every day, we need to identify small, frequent opportunities to set aside money. One approach is to save a fixed dollar amount daily. For example, saving $33.33 each day will get us to our $2000 target in 60 days. Consider automating this process by setting up a daily transfer to a savings account—out of sight, out of mind.

- Ways to save daily:

- Brew coffee at home instead of buying it.

- Pack lunches rather than dining out.

- Opt for free entertainment options.

By focusing on reducing everyday expenses, we turn the act of saving into a regular habit that contributes significantly over time and that’s how to save $2000 in 2 months!

Making the Most of Windfalls

We all receive unexpected windfalls from time to time, whether it’s a tax refund, a bonus from work, or a gift. Rather than spending this extra cash, we can give our savings a substantial boost. Deposit part, or all, of any unexpected funds into our savings account; even small amounts can accelerate our progress.

- Windfall examples:

- Tax refunds: It’s tempting to spend this money, but allocating it to our savings can significantly reduce the time needed to reach our goal.

- Bonuses: If we receive a bonus every month or every two weeks, consider saving a portion of it. It will add up quickly.

Consistently redirecting windfalls to our savings aligns with our investment goal and can help us save $2000 in just two months, maintaining our timeline and making the process more efficient.

Utilizing Tools and Resources

In our quest to understand how to save $2000 in 2 months chart, let’s explore some effective tools and resources that can provide guidance and support.

Savings Calculators and Charts

Calculators are invaluable for planning how to reach our savings goal. They help us break down the target into manageable monthly or weekly contributions, taking into account variables like the interest rate (APR) and compound interest. A good savings calculator can show us the impact of different savings rates and time frames on our end goal. Likewise, a well-designed chart offers a visual roadmap of progress, which can be both motivating and clarifying.

Tracking Your Savings Milestones

Keeping track of our progress is crucial. By setting milestones, we can celebrate our achievements along the way and stay motivated. We might mark these milestones in a simple spreadsheet or a specialized savings app that visualizes our journey with yield and return data, helping us adjust our strategy in real-time to account for factors like taxes or unexpected expenses.

Professional Financial Services

If we’re feeling overwhelmed, professional financial services can be of great assistance. Financial advisors provide expertise in navigating taxes and optimizing returns, while investment services can help grow our savings through strategic asset allocation to potentially increase the yield of our savings. Understanding the interest rate (APR) and compound interest effects on our savings can be tricky, but with the right support, we can make informed decisions that keep our savings plan on track.

Celebrating Success and Planning Next Steps

Achieving a financial goal is an accomplishment worth celebrating. As we look at our “how to save 2000 in 2 months chart,” it’s clear we’ve put in the effort and discipline necessary to meet our target. Now, let’s highlight the joys of reaching this milestone and explore how to set ourselves up for future financial success.

Reaching Your $2,000 Savings Milestone

Hitting our savings goal of $2,000 is a significant achievement that merits recognition. This sum could go toward the down payment on a new car, contribute to a wedding budget, or even kickstart an investment strategy. Upon reaching the milestone, it’s essential to review the journey—taking note of the times when it was challenging to save those extra dollars and comprehending how we managed our expenses more effectively.

Celebrating doesn’t always mean spending lavishly; sometimes, it’s about acknowledging success by sharing the news with supportive friends or treating ourselves modestly within reason.

Setting New Savings Targets

With our initial $2,000 savings goal accomplished, what’s next on our financial horizon? Could it be a more ambitious savings target, like $5,000, or setting aside funds for a specific purpose like a car or a vacation?

- Next Financial Goal:

- Example: Save an additional $3,000 for a total of $5,000

- Timeline: 6 months

- Purpose: Down payment for a car

- Investment or Expense Planning:

- Possibility: Consider investing a portion to potentially grow our savings

- Consideration: Anticipate upcoming expenses that need budget adjustments

Creating a new chart and plan similar to how we learned to save $2000 in 2 months will help us maintain discipline and continue on this empowering path of financial security and freedom.

If you need more help on how to save $2000 in 2 months, our following articles may be helpful:

- Budget Basics 2024: Simple Tips For Managing Your Finances

- Budgeting For Meals: Tips To Save Money On Your Grocery Bill 2024

Frequently Asked Questions

What are effective budgeting strategies for saving $2,000 in a short time period?

To save $2,000 quickly, it’s crucial to create a detailed budget that helps track and reduce unnecessary expenses. Analyze your current spending and cut back on non-essential items. Allocating funds to savings right after you receive your income can also prevent unnecessary spending.

How do I design a savings plan to accumulate $2,000 within two months?

Design a savings plan by first determining the total amount to save each week or bi-weekly to meet your $2,000 target. Then, use a money saving chart to monitor progress and ensure you’re consistently hitting your designated savings targets.

What are some smart ways to adjust my spending habits to save $2,000 in 60 days?

To adjust spending habits effectively, prioritize needs over wants, seek cost-saving alternatives for regular expenses, and use cash or debit cards instead of credit to prevent overspending. Cooking at home rather than eating out can also contribute to your savings.

Are there any financial tools or apps recommended for tracking a $2,000 savings goal over two months?

Yes, there are several financial tools and apps that you can use to track your savings goal. These can help you monitor expenses, set savings targets, and stay accountable. Explore apps mentioned on NerdWallet’s savings goal calculator for recommendations to assist in tracking your progress.