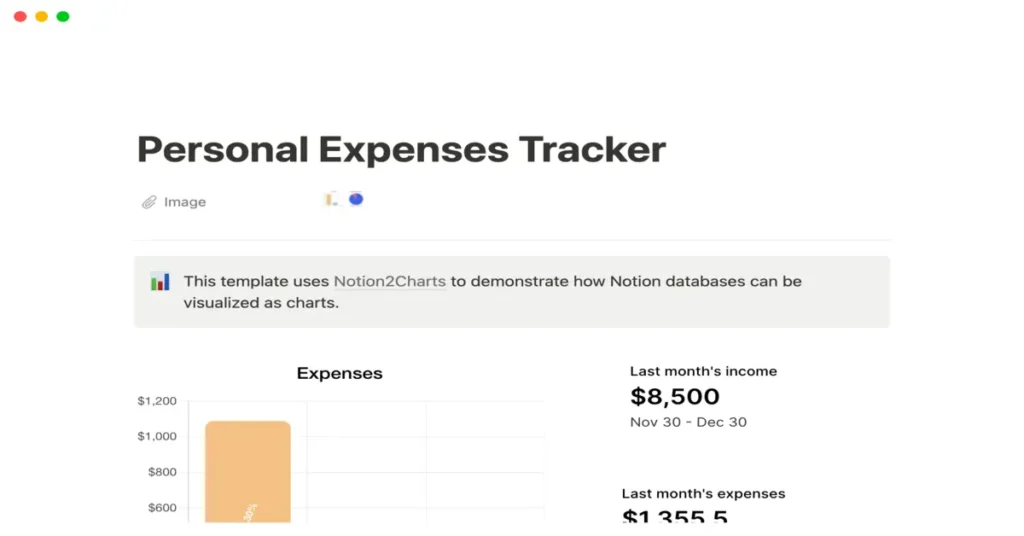

Streamline your finances effortlessly with a Notion budget template, the ultimate tool for customizing your budget to match your lifestyle. This all-in-one workspace turns complex financial tracking into simple, digestible tables and charts, allowing you to oversee spending, plan and achieve your financial goals with ease.

Getting Started with Notion Budget Templates

Finding the right notion budget template can kickstart your journey to financial clarity. These templates are designed to simplify budgeting, tracking expenses, and managing your finances right within Notion’s versatile environment.

Understanding Notion and Templates

Notion combines note-taking, task management, databases, and spreadsheets to organize your work and life. Templates in Notion serve as pre-designed frameworks that you can use to manage various projects, including your budget. They come in various forms, from simple layouts to more complex systems, with options to personalize them according to your specific needs.

Benefits of a Budget Template

A budget template in Notion helps you visualize your income, expenses, and savings, making it more manageable to achieve your financial goals. Using a template streamlines the process of tracking and organizing your finances in one place.

Choosing the Right Template

There is a variety of free and paid Notion budget templates, ranging from minimal to aesthetic designs. Your choice should align with your financial situation and goals. For personal finance, you might prefer a simple budget template, while more intricate templates might be better for managing a business or complex personal finances.

Customization Tips

When customizing a template, consider what’s essential for you to track. You can personalize categories, set up different accounts, and even play with the interface to align with your preferences. Remember, the key with any Notion template is to make it work for you, not the other way around.

Initial Setup Process

Begin by importing your chosen template into your Notion workspace. Next, populate it with your financial data such as monthly income, expenses, savings, and any other relevant financial categories. You can easily customize and adjust the template as you go, ensuring it fully adapts to your budgeting play.

Essential Components of a Budget Template

When I manage my finances with a notion budget template, I focus on a few core components that ensure every dollar is tracked and planned for. Let’s dive into what each of these parts entails.

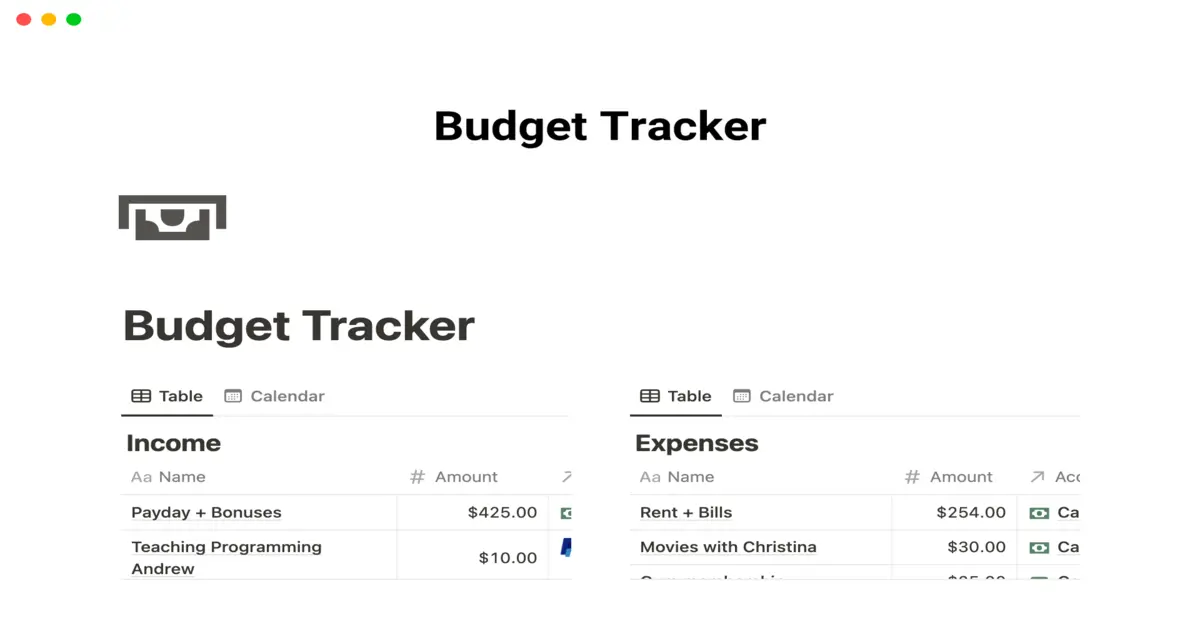

Income Tracker

The Income Tracker is where I record all incoming cash flows. This includes my salary, any side hustles, dividends, and other forms of income. It’s essential to categorize each income source for a clearer understanding of where my money comes from.

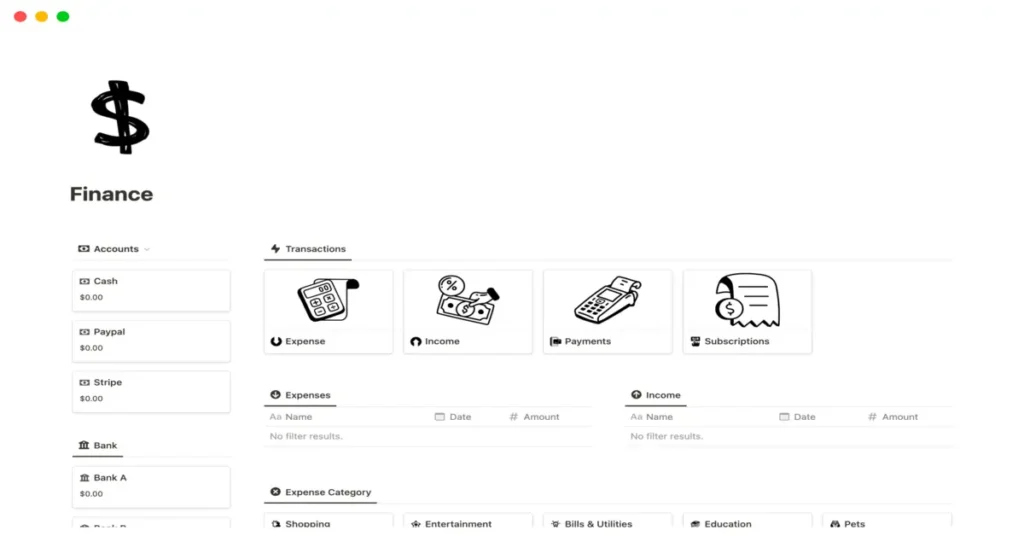

Expense Tracker

Here, I carefully list all my expenses, from bills to that daily coffee. It’s crucial to use an Expense Tracker to categorize spending and see where I can cut back if needed. For recurring payments, such as subscriptions, a Subscription Tracker within the expenses can be very handy.

Savings Goals Tracker

A Savings Goals Tracker keeps my savings goals visible and prioritized. I list my short-term and long-term targets, such as an emergency fund or vacation savings, and track my progress toward these goals regularly.

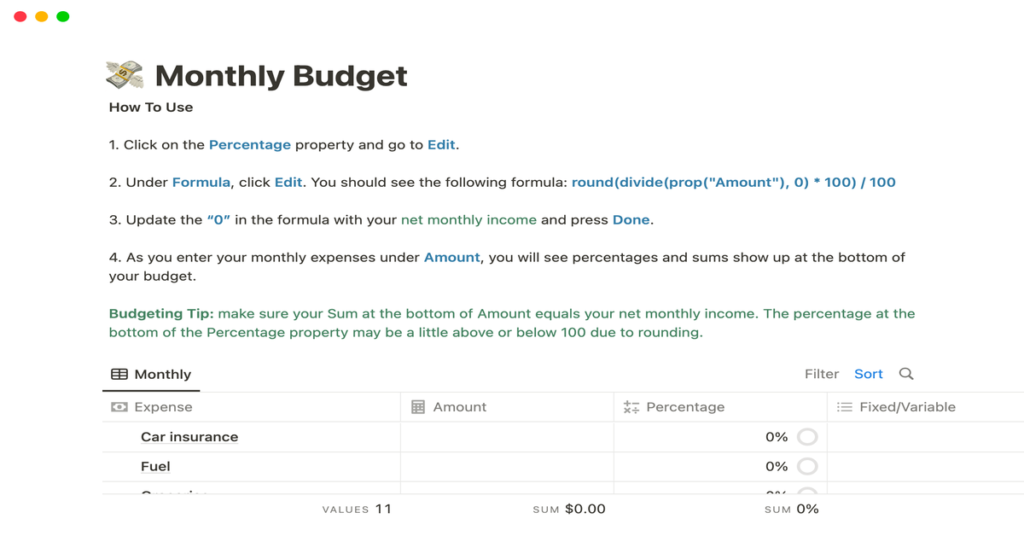

Monthly Budget Planner

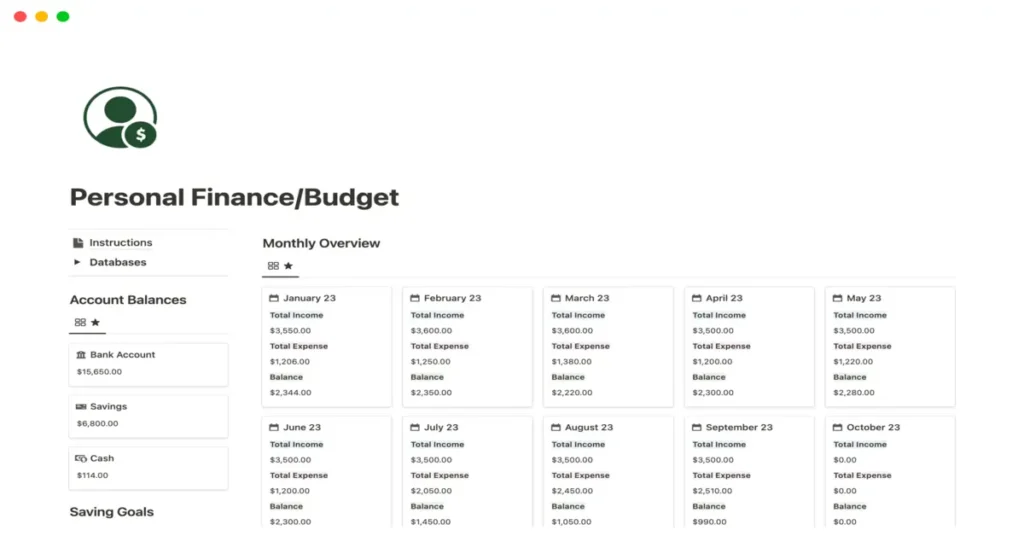

Planning with a Monthly Budget Planner helps me allot funds to different categories and make sure I’m not overspending in any area. It’s the crux of budget planning, showing planned vs. actual spending and allowing for adjustments as the month progresses.

Budget Status Overview

Finally, a Budget Status Overview gives me a dashboard-esque view of my financial health at a glance. It contains a summary of the finance tracker components, including how much of my income is left after expenses and how close I am to my savings goals.

Advanced Features in Notion Budget Templates

As someone who takes their finances seriously, I’ve found that a notion budget template isn’t just about tracking spending—it’s a dynamic tool that can truly transform how you organize and plan your financial life. From automated calculations to sophisticated reporting, there’s a suite of advanced features just waiting for you.

Automated Calculations

I appreciate how my budget planner with an automatic remaining budget does all the heavy lifting for me. With Automated Calculations, every transaction I add adjusts my monthly cash flow. It’s amazing to see my progress update in real time without needing to manually crunch numbers.

Financial Goals Planning

Setting long-term educational or investment goals is a breeze using the Financial Goals Planning subsection. It allows me to outline specific targets and then track my achievements towards them. I find it incredibly rewarding to watch my goals progress and to know I’m staying on target.

Investment Tracking

Investment Tracking within my tool helps me keep an eye on my investments by updating the performance of my portfolio. It’s been an essential feature for making informed financial decisions and understanding how my investments contribute to my overall financial health.

Custom Databases for Tracking

Creating Custom Databases for Tracking allows me to categorize transactions in a way that makes sense for my lifestyle. Whether I’m managing expenses or monitoring income streams, I can organize every aspect of my finances. This personalized database design gives me a clear overview and makes managing my budget manageable.

Reports and Analysis

Lastly, the Reports and Analysis section provides valuable insights into my financial habits. I’m able to review comprehensive reports that help me detect trends and adjust my spending. With these tools, I’ve developed a financial habit tracker that helps me stay disciplined with my expense tracking.

By utilizing these advanced features, I feel empowered as a budget manager. It’s remarkable how much more control I have over my finances with these functionalities at my fingertips.

Managing and Updating Your Budget in Notion

When I started using a notion budget template, my understanding of personal finance was transformed. Not only could I track my monthly expenses with precision, but I could also adapt my budget plan to reflect my financial journey’s changing landscape.

Regular Maintenance

Weekly Check-ins: At the end of each week, I sit down for a quick review. It’s when I open my Expense Categories and log any new transactions. This regular pulse check ensures my budget tracker template mirrors my actual spending and keeps my cash flow insights up-to-date.

- Monthly Expenses: Items such as rent, utilities, and subscriptions are fixed and checked against the expected amounts.

- Spending Categories: For my variable costs like groceries and dining out, I ensure I’m within my spending limits.

- Receipts and Invoices: I upload images of receipts and tie them to expenses to keep everything in one place.

Dealing with Variable Expenses

Tracking Fluctuations: Since costs like fuel and entertainment can vary, I tag these in my budget tracker under Variable Expenses. Here’s how I manage them:

- Review Spending Categories: I evaluate which spending categories have the most variance and adjust my expectations.

- Set Aside Contingencies: For months when I spend less, I put aside some funds for future variability in these categories.

Adjusting Budget for Financial Changes

Adapting to Income Changes: Any alteration in my income leads to a reassessment of my budget plan. I update the expected income and modify my needs and wants accordingly.

- Unexpected Earnings: Bonuses or freelance work income gets allocated to savings or financial goals such as education.

- Expense Reallocation: Budget surplus might be redirected towards debts or investments, aligning with my long-term aims.

Year-End Finance Review

Annual Overview: I find it beneficial to conduct a thorough year-end review of my finances. It entails:

- Progress Against Goals: Comparing my financial decisions throughout the year against the goals I had set.

- Reports and Analysis: Using Notion’s database features to generate reports showing patterns in my income/expense logs.

- Planning for Next Year: This deeper analysis feeds into the strategy for the upcoming year’s budget plan.

Keeping my finance tracker up-to-date in Notion is a dynamic, ongoing process that has vastly improved my control over my monthly expenses and overall financial health.

Integrations and Enhancements

When I explore a notion budget template, I’m always impressed by various ways to make budgeting more interactive and connected. It’s not just about recording numbers; it’s about linking real-world information and automating tasks to simplify finance management.

Linking Bank Accounts and Cards

One of the most practical features I leverage is the ability to import bank transactions directly into the budget template. Not only does this save time, but it also helps in keeping track of spending without manual entries. The process generally involves secure OAuth authentication to connect my bank account and cards to the template. Once set up, transactions flow in, categorized into the appropriate expense tracker fields. This seamless integration means I can organize my financial overview effortlessly, watching my subscriptions and recurring expenses get updated in real time.

Incorporating Savings Challenges

Saving money can often feel like a daunting task, but integrating a 30-day saving challenge into a notion budget template makes it more engaging. I set up simple finance trackers within the template to track spending and focus on savings goals. Each day, I task myself with a small saving objective, and the incremental progress is automatically updated. It’s a fun and satisfying way to enhance my savings without feeling burdened, and the visual progress indicators in the notion budget template help keep me motivated.

Resource Guides

When it comes to managing finances, a good notion budget template can be a game-changer. I’ve gathered some essential guides to help you navigate through the wealth of resources available for tracking and planning your budget in Notion.

Finding Notion Budget Resources

Where to Find Templates:

- Notion’s Official Template Gallery: Look for budgeting and finance templates tailored for personal use or business needs.

Key Template Features to Seek Out:

- Budget Templates: Essential for organizing and planning your expenses.

- Expense Tracker: Helps you monitor outgoings more accurately.

- Income Tracker: Offers insight into your various income streams.

Learning from Community Templates

Community templates can be a goldmine for discovering nuanced approaches to budgeting. They sometimes include comprehensive tools like a finance tracker or specific versions like student budget planners. For instance, find a budget tracker that aligns with the popularized 50/30/20 budgeting rule, which is curated by Notion users and includes features for customization.

Community Resources:

- Blogs and Notion Enthusiast Sites: They often have lists of templates, like the “12+ Best Finance & Budget Notion Templates [2023]” roundup that might include the perfect notion finance templates for you.

- Notion-Focused Forums: Platforms like Reddit’s Notion subreddit provide space for sharing templates and tips.

Tutorials for Beginners

Start on the right foot with tutorials that walk you through setting up and using your chosen Notion template. Video tutorials are especially helpful if you prefer visual step-by-step guidance.

Finding Tutorials:

- Notion’s Resources: Learn directly from the source with guides on how to incorporate a simple budget template into your workflow.

- Creator Blogs: Template creators often publish walkthroughs, like Nick Lafferty’s in-depth blog on “11+ Finance & Budget Notion Templates” which covers using an expense tracker and income tracker within Notion.

Frequently Asked Questions

Can Notion be used for budgeting?

Yes, Notion can be used for budgeting. It offers various budget templates that can help you track your spending, plan for the future, and manage your financial goals efficiently.

Can you use Notion to track finances?

Absolutely, tracking finances is one of Notion’s multiple capabilities. By using its templates or creating a customized finance tracker, you can systematically monitor your expenses, income, and financial habits.

How do you make a budget tracker in Notion?

Making a budget tracker in Notion involves setting up a template that fits your specific financial situation. You can start from scratch or modify existing budget templates to create a tracker that includes your income, expenses, and savings goals.

Is there a free budget template?

Indeed, there are free budget templates available in Notion. You can find a variety of options that cater to different budgeting methods, whether you’re looking for a simple tracker or a complex financial planner. Many creators offer these templates at no cost, such as the Notion Budget Templates by various financial experts.

I hope you found some inspiration or useful tips in our article on Notion budget template! If so, I’d love to hear your thoughts and ideas in the comments below! And if you’re looking for more insightful content, don’t hesitate to explore our other articles:

- How To Financial Life Planning In 15 Easy Steps

- Strategic Budget: Beginners Guide for Success

- Budgeting Questions: My Top 10 When Crafting My Budgets

- 20/40/60 Rule: Simplifying Life Decisions

Your comments help us create better content for you. Happy reading!