Navigating your finances can often feel like a tightrope walk, but employing a simple budgeting method can offer stability and clarity. That’s where the 60 20 20 rule comes into play—it’s a framework that helps us allocate our income into three distinct categories. We dedicate 60% to essential expenses, 20% to savings and investments, and the remaining 20% to whatever our heart desires. This strategy not only brings order to our financial life, but it ensures that we’re covering all our bases from living costs to future planning and personal enjoyment.

Implementing the 60 20 20 rule can start with dissecting our monthly income. The majority, the 60%, covers our needs—the non-negotiables like rent, groceries, and utilities. The first portion of 20% is whisked away into savings or retirement accounts, making sure our future selves are just as secure as we are today. Finally, the last segment allows for fun and leisure because it’s important that our hard-earned money also provides pleasures and experiences that enrich our lives.

Key Takeaways

- The 60 20 20 rule simplifies budgeting into manageable segments.

- Prioritizing essential expenses, savings, and fun can provide financial balance.

- Adapting the rule to our individual income ensures both needs and desires are met.

What is the 60 20 20 Rule

When we talk about budgeting, it’s essential to have a structure that suits our financial goals and lifestyle. That’s where the 60 20 20 rule comes into play, offering a simplified way to manage money.

Definition of the 60 20 20 Rule

The 60 20 20 rule is a percentage-based budgeting framework designed to simplify your financial choices. It suggests allocating your after-tax income into three categories:

- 60% for Living Expenses: This portion covers all the necessities, such as housing, utilities, groceries, and transportation.

- 20% for Savings: This is your financial cushion, aimed at future needs, emergencies, retirement, or debt reduction.

- 20% for whatever you desire: This allows you to enjoy the fruits of your labor without overindulging, covering expenses like dining out, hobbies, and vacations.

This rule differs from the strict constraints of a zero-based budget where every dollar is assigned a role, and it’s less restrictive than the 50-30-20 rule, which allows only 30% for wants. Unlike the 80-20 rule, which emphasizes savings, the 60/20/20 rule provides a more balanced approach, acknowledging that while saving is vital, so is living a fulfilling life. By no means a one-size-fits-all solution, the 60/20/20 rule can be adapted to fit individual financial situations and goals.

Allocating the 60 Percent: Essential Expenses

When we apply the 60 20 20 rule to our finances, the majority of our income is dedicated to essential expenses. Let’s focus on how we can map out these costs effectively.

What Counts as Essentials

Essentials are the non-negotiables in our monthly budget—the costs we must cover to maintain our basic quality of life. These typically include:

- Housing: Whether it’s rent or mortgage payments, this is usually our biggest expense.

- Utilities: Electricity, water, gas, and other basic services are vital.

- Groceries: Nutrition and sustenance are necessary for our health and well-being.

- Transportation: This includes car payments, fuel, or public transit costs to get us where we need to go.

- Health Insurance: Ensuring we can access medical services without financial hardship.

Remember, while essentials are unique to everyone’s situation, they generally include what we need to live safely and comfortably.

Creating a List of Fixed Costs

To manage our essentials, we create a list of fixed costs—the expenses that don’t change much from month to month. Here’s what that might look like:

| Fixed Costs | Estimated Monthly Amount |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities | $300 |

| Groceries | $500 |

| Transportation | $400 |

| Health Insurance | $250 |

| Total | $2,650 |

By listing these costs, we give ourselves a clear picture of our essential financial commitments and ensure these are prioritized in our budget according to the 60 20 20 rule.

Assigning the 20 Percent: Savings and Investments

By incorporating the 60 20 20 rule into our financial planning, we ensure that 20% of our income is deliberately set aside for savings and investments. This deliberate action cultivates financial security and lays a foundation for future wealth accumulation.

Building an Emergency Fund

Creating an emergency fund is a critical starting point. This fund is a safety net for unexpected expenses that can arise, offering us peace of mind. Ideally, it should cover three to six months of living expenses.

- Start small: Even a modest goal, like $1,000, can provide significant security.

- Consistency is key: Regularly contribute to a dedicated savings account to grow this fund.

Contributing to Retirement Accounts

Investing in retirement accounts, such as an IRA (Individual Retirement Account), helps ensure that we’re preparing for our future.

- Diversify investments: Include a mix of stocks, bonds, and potentially real estate to spread out risk.

- Take advantage of employer matches: If our employer offers a matching contribution to a 401(k) or similar plan, we should aim to maximize this benefit to enhance our retirement savings.

Using the Remaining 20 Percent: Discretionary Spending

When we embrace the 60 20 20 rule, we allocate 20 percent of our income to the joys and extras in life. This is our opportunity to fund our wants, not just our needs, and to enjoy the fruits of our hard work without impacting our essential expenses or financial goals.

Understanding Wants vs. Needs

Wants are the extras that bring us happiness and satisfaction, like the latest pair of shoes or a chic outfit. They’re not essential for survival, but they do make life more enjoyable. Needs, on the other hand, are the must-haves for maintaining our basic living standards, such as housing and groceries. To prevent overspending, it’s crucial to clearly distinguish between the two. Here are some tips to keep in mind:

- List out your wants: Take time to write down what you consider luxuries in your financial life.

- Prioritize wisely: Decide which wants are most important to you, maybe it’s updating your wardrobe bi-annually or saving for a special holiday.

- Review monthly: Regularly look at your spending habits to ensure they align with your priorities.

Remember, thoughtful management of our discretionary spending can significantly enhance our productivity and happiness.

Managing Leisure and Entertainment

Allocating funds for leisure and entertainment is an essential part of enjoying life and should be factored into your discretionary spending. Here’s how we can do it responsibly:

- Budget for fun: Designate a portion of your 20 percent for activities that rejuvenate you, whether that’s dining out, movies, or concerts.

- Avoid impulsive buys: It’s tempting to splurge on the spur of the moment, especially for clothes or entertainment. Creating a mini-budget within your 20 percent can help curb this.

- Track your spending: Use a simple system or app to keep an eye on where your discretionary income is going.

By being mindful of our leisure expenses, we ensure they contribute positively to our lives without causing financial strain.

Adapting the 60 20 20 Rule to Your Life

We’re about to explore how we can apply the 60 20 20 rule to manage our finances, ensuring a balanced approach to handling our monthly income.

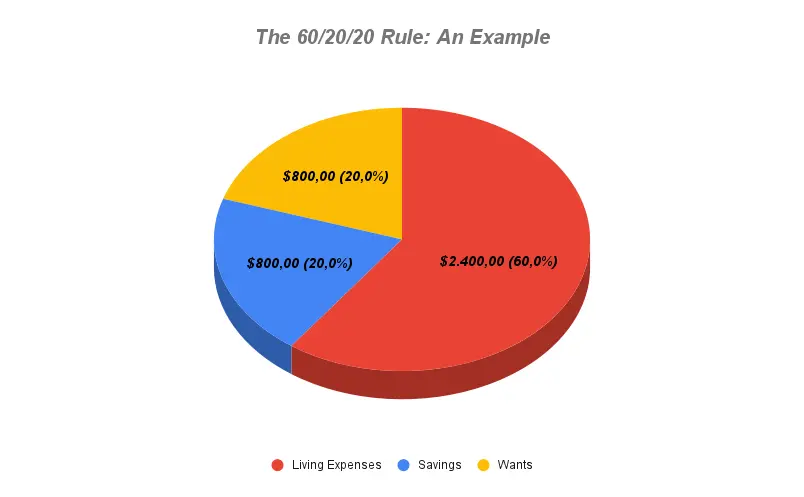

The 60 20 20 Rule: An Example

Let’s say your net monthly income is $4,000. According to the 60/20/20 rule:

- 60% for expenses = $2,400 (This covers all essential costs like housing, groceries, and utilities)

- 20% for savings = $800 (This goes into retirement savings or an emergency fund)

- 20% for wants = $800 (This is for dining out, hobbies, or other personal pleasures)

You can use a simple budget template to allocate these amounts accordingly.

Flexibility Within the Structure

One of the strong points of the 60 20 20 rule is its built-in flexibility. You might find that your lifestyle requires adjustments to the categories:

- If your essential expenses are lower, you could move funds to savings or discretionary spending.

- For a freelancer whose income varies, percentages can adapt monthly, maintaining financial stability.

Adjusting to Life Changes

Our lives are not static, and whether it’s due to a new partner, children, or a career shift, the budget must adapt:

- A growing family might see increased expenses, reducing discretionary funds.

- Alternatively, a dual-income household could provide extra room for savings or investment.

By consistently reviewing and adjusting the budget, the 60 20 20 rule remains effective across different life stages.

Tools and Resources for Effective Budgeting

When we tackle the 60 20 20 rule for our budgets, we’re committing to a structured approach to managing our finances. It’s crucial to have the right set of tools that can help us allocate 60% of our income to essentials, 20% to debt repayment and savings, and the remaining 20% to personal spending. Let’s take a look at the instruments that can make adhering to this rule more manageable and efficient.

Using a Budgeting App

Budgeting apps have become an indispensable financial tool for tracking expenses and managing money on the go. Apps like Mint and You Need A Budget (YNAB) offer features that automatically categorize our transactions—splitting them into essentials, savings, and personal spending. This aligns perfectly with the 60 20 20 rule, making it easier for us to visualize where our money is going every month.

Essentials: Apps can highlight recurring expenses like rent or mortgage, utilities, groceries, and car repairs, ensuring we stay within the 60% allocation.

Savings/Debt Repayment: Budgeting apps also assist us in tracking our savings for that rainy day fund or streamlining our student loan and debt repayment plans.

Personal Spending: They provide insights into our discretionary spending, helping us stay accountable for the remaining 20% of our income.

Creating a Custom Budget Spreadsheet

For those of us who love customization, spreadsheets offer flexibility and control. A well-designed custom budget spreadsheet can be tailored to reflect the 60 20 20 rule, and it serves as a dynamic tool to adjust our allocations as our financial situation changes.

Templates: Start with a basic budget template and modify it to fit our specific needs.

Tracking: We can detail all of our income sources and expenses, including debts and investment accounts.

Analysis: It enables us to dive deep into our expenses and savings, giving us the power to analyze and make informed decisions.

Using a spreadsheet means we become our own financial analyst, and with a bit of diligence, we can become savvy at predicting future needs for things like emergency car repairs or next semester’s student loans. It’s all about taking the essence of the 60 20 20 rule and making it work for our unique financial journey.

Our Opinion on the 60 20 20 Budget Rule

The 60/20/20 rule serves as a simple, flexible framework for my financial planning. It not only helps me manage my monthly expenses but also reinforces the importance of achieving long-term savings goals.

- 60% Monthly Living Expenses: Ensures our necessities like rent and groceries are comfortably covered.

- 20% Financial Goals: Prioritizes our future, be it debt repayment or investment.

- 20% Lifestyle Choices: Allows us personal freedom without compromising financial stability.

By adhering to this budgeting guideline, I create a balanced approach towards spending and saving. It encourages me to be mindful of where my money goes and helps me to make financial decisions with a clear structure.

Embracing the 60/20/20 budget rule can be our stepping stone to nuanced money management. It’s about finding what works for you and continually refining your approach to ensure that financial peace of mind isn’t just a goal—it’s a reality.

Frequently Asked Questions

We’ve gathered some of the most common inquiries about the 60 20 20 rule to help clarify how this budgeting framework can be beneficial in managing personal finances effectively.

How does the 60/20/20 budgeting framework function?

The 60/20/20 budgeting framework is simple: 60% of your after-tax income is allocated for monthly living expenses—essentials like rent or mortgage, groceries, utilities, and transportation. Balancing your financial life becomes more manageable because this portion covers your needs. The remaining 40% is split evenly, with 20% going towards savings, which may include emergency funds, retirement, or debt repayment, and the other 20% is reserved for personal wants—non-essentials like dining out, hobbies, and entertainment.

What are the benefits of applying the 60/20/20 rule in personal finance?

Applying the 60/20/20 rule brings multiple benefits. It aims to simplify money management by creating a clear structure for spending and saving. This method can help prevent overspending by allocating a set percentage of income to wants, savings, and needs, fostering financial discipline. It also encourages the growth of your savings, ensuring you progressively work towards financial goals and stability.

What is the rule of thumb for 60 20 20 personal finance?

The rule of thumb for the 60/20/20 personal finance approach is to practice a balanced division of your income. Creating a 60/20/20 budget requires you to first understand your take-home income, and then categorize your expenses into necessities, savings and wants. This methodology serves as a foundation to maintain healthy financial habits, ensuring each dollar you earn is assigned a specific purpose, improving overall financial well-being.